Welcome to our weekly edition of what's hot in social media news. To help you stay up-to-date with social media, here are some of the news items that caught our attention.

Welcome to our weekly edition of what's hot in social media news. To help you stay up-to-date with social media, here are some of the news items that caught our attention.

What's New This Week?

Facebook Seeks to Raise $5 Billion in IPO: “Social networking titan Facebook filed to go public, seeking to raise $5 billion in the largest flotation ever by an Internet company on Wall Street.” Facebook shares are not expected to begin trading for several months. Experts expect this initial public offering to be much larger than Google was when it went public. Do you plan on investing in Facebook? Leave your comments below.

https://www.youtube.com/watch?v=zEXhNVDN-OI

Facebook IPO Reveals New Usage Numbers: Facebook's nearly 200 page IPO documents revealed that Facebook now has 845 million active users, with 483 million people logging in daily. Facebook also sees Google+ as a big competitive threat.

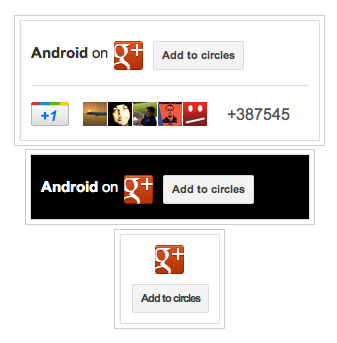

More Options for Google+ Badges: Google+ page owners now have a choice of badges to put on their website. You can configure badges with a width that fits your design and choose one to complement your website.

Here are a few social media tools worth noting:

Discover Proven Marketing Strategies and Tips

Want to go even deeper with your marketing? Check out the Social Media Marketing Podcast! Publishing weekly since 2012, the Social Media Marketing Podcast helps you navigate the constantly changing marketing jungle, with expert interviews from marketing pros.

But don’t let the name fool you. This show is about a lot more than just social media marketing. With over 600 episodes and millions of downloads each year, this show has been a trusted source for marketers for well over a decade.

Salesforce Launches Desk.com and Desk.com Mobile: Salesforce‘s new services Desk.com and Desk.com Mobile are a “social help desk specifically targeted for small and mid-sized businesses (SMB). Desk enables businesses to deliver personal customer service using a help desk that is social, mobile, and easy to use and deploy: key attributes for any SMB today looking to leverage social enterprise technologies.”

http://www.youtube.com/watch?v=UClF_DhDO_I&feature=player_embedded

Ifbyphone: Hubspot adds the Ifbyphone’s LeadResponder app to their marketplace. LeadResponder enables HubSpot customers to quickly connect with and convert qualified inbound marketing leads through the use of voice-based marketing automation.

So.cl: The social search experiment from Microsoft Research FUSE Labs.

And here's an interesting infographic:

Is Pinterest the Next Social Commerce Game Changer?:

What social media news caught your interest this week? Please share your comments below.

Attention Agency Owners, Brand Marketers, and Consultants

Introducing the Marketing Agency Show–our newest podcast designed to explore the struggles of agency marketers.

Join show host and agency owner, Brooke Sellas, as she interviews agency marketers and digs deep into their biggest challenges. Explore topics like navigating rough economic times, leveraging AI, service diversification, client acquisition, and much more.

Just pull up your favorite podcast app, search for Marketing Agency Show and start listening. Or click the button below for more information.