Are you looking into Web3 for business? Wondering about the legalities involved with NFT launches, accepting cryptocurrency as payment for goods, managing partnerships, and more?

In this article, you’ll learn what you need to know about the legal implications of doing business in Web3.

Why Marketers and NFT Project Owners Need to Understand the Legal Aspects of Web3

As the opportunities for businesses and marketers grow in Web3, the legal issues and challenges also grow.

Lawyers have more and more clients asking for guidance about local, federal, and international laws as they pertain to the blockchain, non-fungible tokens (NFTs), smart contracts, decentralized autonomous organizations (DAOs), and the metaverse as they’re incorporated into their business models. Considerations must also include intellectual property, contracts, jurisdiction, profits, and taxes.

Make no mistake, the law does apply to Web3 ventures. People are being indicted and held accountable for engaging in wrongful conduct with Web3 technologies.

You may be tempted to jump in and throw caution to the wind but it will be worth your time to slow down just a bit and consult a legal authority to make sure your plans align with and adhere to the laws and regulations that govern your business.

Let’s take a look at some common areas of struggle for marketers, entrepreneurs, artists, musicians, and creators interested in NFTs, Web3, and the metaverse.

#1: Legal Entities in Web3

There’s a startling lack of use of legal entities to do business in Web3 and the metaverse.

Whether you as an artist are creating NFTs to sell in virtual spaces or you’re developing an NFT project, the major benefit of working with multiple legal entities for Web3 ventures is liability protection.

In a traditional business model, if someone—say a dentist—wants to set up business in California, Mitch recommends they set up a corporation in California. Then they set up a limited liability company (LLC) to purchase office and dental equipment. The LLC will hold title to that equipment and lease it back to the corporation run by the dentist. A third entity (another LLC or a second corporation) is set up to hire employees. These entities work together to provide protective liability and maximize tax options.

If something happens with the business and the owners are faced with a claim, they have a corporate veil in place—a legal wall between the business’ liability and the owner’s personal assets. Their bank account, retirement plan, and other personal assets are protected.

Moving forward, Mitch is encouraging clients who are entering into Web3 ventures to set up similar types of legal entities such as LLCs or S corporations for themselves and their ventures.

If you’re launching an NFT project in California, for instance, the first thing on your legal agenda would be to consider setting up an LLC or S corporation for the project, and then a second legal entity to handle your first NFT drop. There should be agreements between the original legal entity and second legal entity to provide for the rights, liabilities, and remedies among all of the players. As the project grows, a separate LLC or corporation should be set up for each successive NFT drop.

How do these legal entities function?

Get World-Class Marketing Training — All Year Long!

Are you facing doubt, uncertainty, or overwhelm? The Social Media Marketing Society can help.

Each month, you’ll receive training from trusted marketing experts, covering everything from AI to organic social marketing. When you join, you’ll also get immediate access to:

- A library of 100+ marketing trainings

- A community of like-minded marketers

- Monthly online community meetups

- Relevant news and trends updates

Let’s say you’re involved in a project that communicates and makes decisions using a DAO. If the designer handling the artwork for your NFTs uses someone else’s IP in the design but doesn’t acquire the IP rights, you’re personally protected from any claims brought forward by the owner of the IP because the legal entity for the NFT project (not you, personally) is contracting with the designer.

Legal entities and agreements can also help protect you from consumer class-action lawsuits. To visualize this, if a bad actor associated with the platform that’s hosting your NFTs uses insider information to buy or sell and profit from your NFTs, you want as many legal entities or layers as possible between you and that conduct.

#2: Tax Implications of Web3

The earnings and revenue from NFT projects, Web3, and the metaverse can be convoluted and complicated. For example, smart contracts coded into NFTs ensure that in addition to the earnings from your initial mint, you can also collect revenue each time one of your NFTs changes hands.

This all feels new, but as the Internal Revenue Service and the Department of Justice are getting up to speed, more cases and lawsuits are being filed.

How can you protect yourself?

First, understand that every single transaction could be a taxable event. The purchase of cryptocurrency with fiat money such as U.S. dollars is potentially a taxable event. Using cryptocurrency to purchase an NFT is potentially a taxable event. Selling or using an NFT as security for a third-party transaction is potentially a taxable event.

Second, work with a highly qualified and reputable accountant or Certified Public Accountant who’s familiar with digital assets in Web3. Their advice can help you minimize your tax liability.

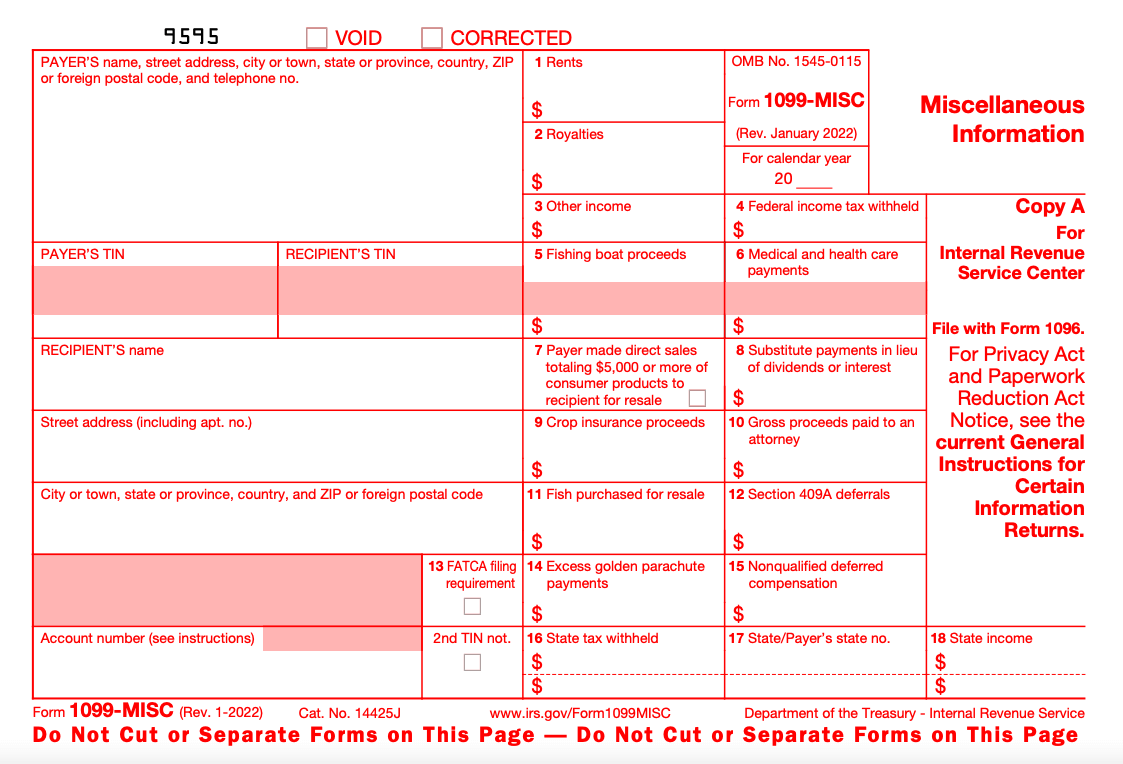

Third, pay attention to the 1099s that platforms send you for the purchase and sale of your digital assets. Often, the amount noted on those 1099s isn’t accurate because the platform doesn’t have the full history: where you first purchased the digital currency you transferred to the platform, where you purchased the NFT, and so on. All creators and business owners should review these documents with their accountant or CPA.

Fourth, pay attention to U.S. tax code 6050I, also known as the Gift Tax, which says that the transfer of anything with a value of $10,000 or more to a third party must be reported. This code applies to digital or cryptocurrency and NFTs so you’ll need to work with your accountant or CPA to set up your transfers to minimize negative tax implications and maximize your profit.

Pro Tip: Be aware that accepting an NFT as a reward from a project (essentially, accepting a digital asset as payment for executing a specific action) means that you may receive a 1099 from the project that must be reported as income on your taxes.

#3: Intellectual Property Rights and Fair Use in Web3

Simply stated, intellectual property (IP) rights say that if you create original content, then you have a copyright on that content and you have the right to decide who gets to use that content. IP rights extend to a piece of art, software algorithm, string of code in a smart contract that works within the Web3 and NFT space, and so on.

Many people's IP is used by third parties to create NFTs, design virtual office space in the metaverse, and other activities, and often that IP is used without proper permissions—either in good faith or with bad intent.

The biggest area of confusion in these instances is based around the Fair Use Doctrine because most people don’t have an adequate understanding of what qualifies as fair use and what exceeds the bounds of fair use.

Fair Use as codified under Title 17 U.S. Code, Section 107, is a doctrine in the United States that permits limited use of copyrighted material without having to first acquire permission from the creator or the person who holds ownership rights to that material.

Fair Use Doctrine revolves around purposes of use when it comes to criticism, comment, news reporting, and teaching, including creating multiple copies for a classroom.

If you’re using somebody else's content without their permission for anything other than these purposes, such as commercial purposes and/or sales of your products or services, your use does not fall under the Fair Use Doctrine and you’re likely violating someone's intellectual property rights.

How can you avoid violating IP rights?

If you didn't create the artwork or content you want to use and you haven’t acquired written permission and legal rights from the content creator or the owner or appropriate licensing rights from the appropriate third-party licensee agency to use that content, don't use it.

To use artwork or content you didn’t create in an NFT, you have two options to head off legal problems by documenting everyone's position in writing.

Discover Proven Marketing Strategies and Tips

Want to go even deeper with your marketing? Check out the Social Media Marketing Podcast! Publishing weekly since 2012, the Social Media Marketing Podcast helps you navigate the constantly changing marketing jungle, with expert interviews from marketing pros.

But don’t let the name fool you. This show is about a lot more than just social media marketing. With over 600 episodes and millions of downloads each year, this show has been a trusted source for marketers for well over a decade.

If your designer(s) didn’t create the artwork or content you want to use, someone representing the NFT drop LLC needs to reach out to all designers and require them to confirm in a written document that they have acquired any and all IP rights.

Alternatively, if the designer is the original creator of the original artwork or content you want to use, require them to confirm in a written document that they’re transferring all IP rights to your NFT drop LLC to use in any way your LLC wants in exchange for compensation.

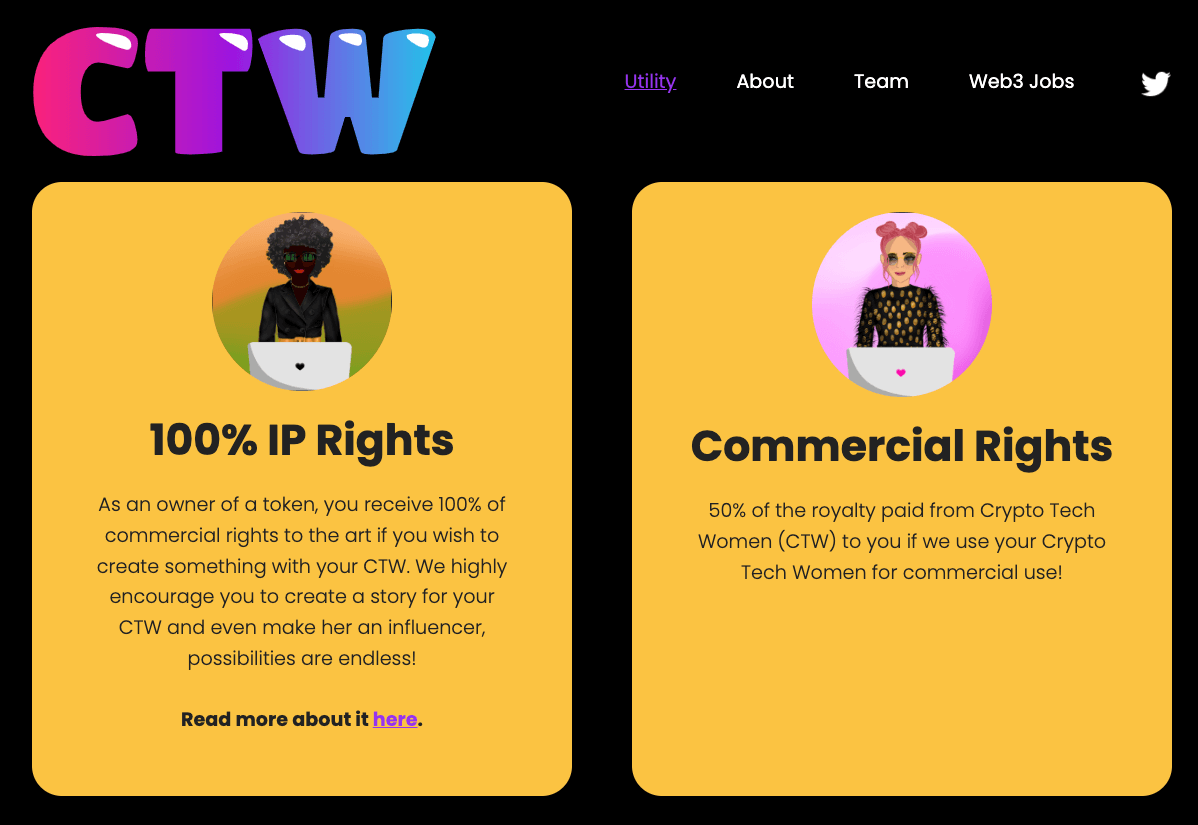

When you buy NFTs, 99 times out of 100, you don’t also acquire the IP rights behind that NFT and the digital art.

Make sure you review and understand all of the written documentation behind the purchase of your NFT so you can ascertain whether you're also acquiring limited or full IP rights so you know what you legally can and can’t do with that NFT moving forward.

Whether you’re purchasing or selling NFTs, you need to understand the terms of service agreements and licensing agreements.

It’s highly recommended that you have your lawyer look at the terms of service and licensing agreements, because if anything goes wrong, they’ll affect the venue for litigation, the scope of your rights, what people can be held accountable for, and the remedies available to you.

#4: NFTs and Security Laws

As the Web3/digital currency/NFT spaces mature, there are some questions involving security law and NFTs. Is your NFT a security? Are the drops that you're participating in violating SEC rules and regulations?

In 1946, the Howey case was tried before the United States Supreme Court. The result laid out four factors that are used to determine whether an instrument may be deemed a security under the SEC.

The Howey Case

A security is a financial instrument, like a stock, that falls under the governance of the Security and Exchange Commission (SEC) via rules and regulations that apply when you sell stocks and transact in securities.

Simplified, the Howey test asks whether there is: (1) an investment of money, (2) in a common enterprise, (3) with the expectation of profit, and (4) to be derived by the efforts of a promoter or third party.

You can use this series of questions to help decide whether you think the NFT project(s) you’re involved with fall within Howey’s guidelines.

Is there an investment of money…

Is there an investment of money that's being asked of you or that you're asking of other people to become part of the community or NFT project?

…in a common enterprise…

Is this a common NFT drop? Does the NFT project have a name? Does it have a community? Does it have its own Discord?

…with an expectation of profit…

Many NFT projects are built to enable their community to do good in society, but there’s also a profitability component. Take that into consideration.

…and is the profit expected to be derived by the efforts of a promoter or third party?

Is there somebody identifiable behind the NFT project, or is the project being pushed by an unknown person or persons via a DAO?

If your NFT collection or project does align with the determination of a security, it’s fine; you simply have to register appropriately with the SEC.

#5: Legalities Around DAOs

The legalities surrounding DAOs are fuzzy at best right now because DAOs are untested in a court of law.

We don't know what state and federal legislatures are going to do when it comes to tax ramifications with DAOs.

There hasn’t been a litigated case in front of a judge or a jury where someone has said, “Here's the DAO, here are the players, here's the issue. Your honor, tell us what happens next with the decentralized legal entity that's a center of this lawsuit.”

As DAOs progress and become more mature, it’s highly likely they’ll be codified in different states, but it will take a few years for the law to catch up with the idea behind DAOs.

Wyoming has some statutes treating DAOs similar to an LLC, and California has the California Corporations Code, which lays out all the rights, remedies, obligations, and duties of everybody involved in corporation law.

Right now, people in other states who want to create a DAO to sell products or services or to support an NFT drop should consider establishing legal entities because they're tested in a court of law.

Organizations that want to create a DAO to do something good for the community should also consider creating a legal entity first and then wrapping the DAO with an LLC or corporation before moving forward with the DAO project.

Using this type of legal entity structure does two things.

One, as mentioned above, the structure minimizes tax consequences (which many people don't consider when it comes to DAOs). If there's a profit, who's responsible? Who pays the taxes?

Two, it provides a clear picture for potential investors.

If you’re a startup that wants to use a DAO to fund a new product or service, you're not going to get a venture capitalist if they don't know who's in control. They’ll want to be certain there are safety valves set up to keep the wrong people from coming into that DAO. Because it only takes one bad actor to bring down a company, one bad brand ambassador to completely turn a product upside down.

Mitch Jackson is an award-winning attorney with clients in the tech, metaverse, and Web3 spaces. He’s also a consultant, speaker, and co-author of The Metaverse Handbook.

Other Notes From This Episode

- Learn more about the Fair Use Doctrine.

- Find out more about The Howey Case.

- Connect with Michael Stelzner at @Stelzner on Instagram and at @Mike_Stelzner on Twitter.

- Watch the interview and other exclusive content on the Crypto Business YouTube channel.

Listen to the Podcast Now

This article is sourced from the Crypto Business podcast. Listen or subscribe below.

Where to subscribe: Apple Podcast | Google Podcasts | Spotify | Amazon Music | RSS

✋🏽 If you enjoyed this episode of the Crypto Business podcast, please head over to Apple Podcasts, leave a rating, write a review, and subscribe.

Disclaimer: The information provided on this website is provided solely for educational purposes and does not constitute any advice, including but not limited to, investment advice, trading advice or financial advice, and you should not treat any of the website's content as such. Social Media Examiner recommends that you independently research any information contained on this Website and that you speak with an investment professional before making any decision to purchase, trade, hold or sell cryptocurrency. Nothing herein should be treated as a recommendation to buy, sell or hold cryptocurrency. Social Media Examiner cannot guarantee the accuracy of any information listed on the website and is not responsible for any missing or wrong information. All information is provided as is and should be used at your own risk. Social Media Examiner disclaims all responsibility and liability for your use of any information found on the website.

Attention Agency Owners, Brand Marketers, and Consultants

Introducing the Marketing Agency Show–our newest podcast designed to explore the struggles of agency marketers.

Join show host and agency owner, Brooke Sellas, as she interviews agency marketers and digs deep into their biggest challenges. Explore topics like navigating rough economic times, leveraging AI, service diversification, client acquisition, and much more.

Just pull up your favorite podcast app, search for Marketing Agency Show and start listening. Or click the button below for more information.